Whether one is an entrepreneur or an angel investor looking to back one, understanding the market landscape in which the start-up in question will operate is the first order of business. To do this, one must adopt a beginner’s mentality and question all assumptions - especially those made by the start-up’s founders. In the first of three posts, we will examine the basic components of a market landscape analysis used to assess a start-up for potential investment. The second post will look with more detail at the customers in that market and what they really need. In the final post, we will address the competition and whether the start-up is prepared enough to defend their market position or avoid competition altogether.

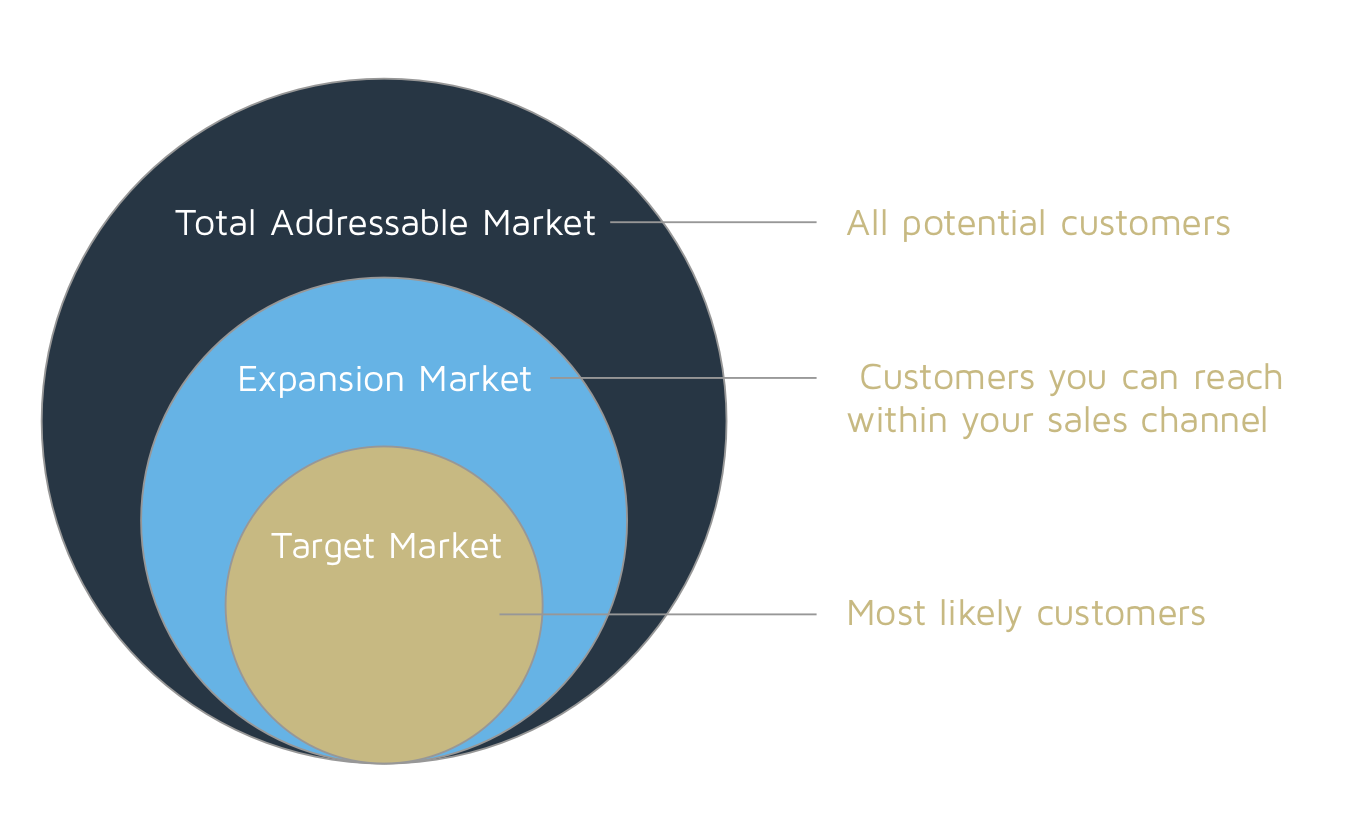

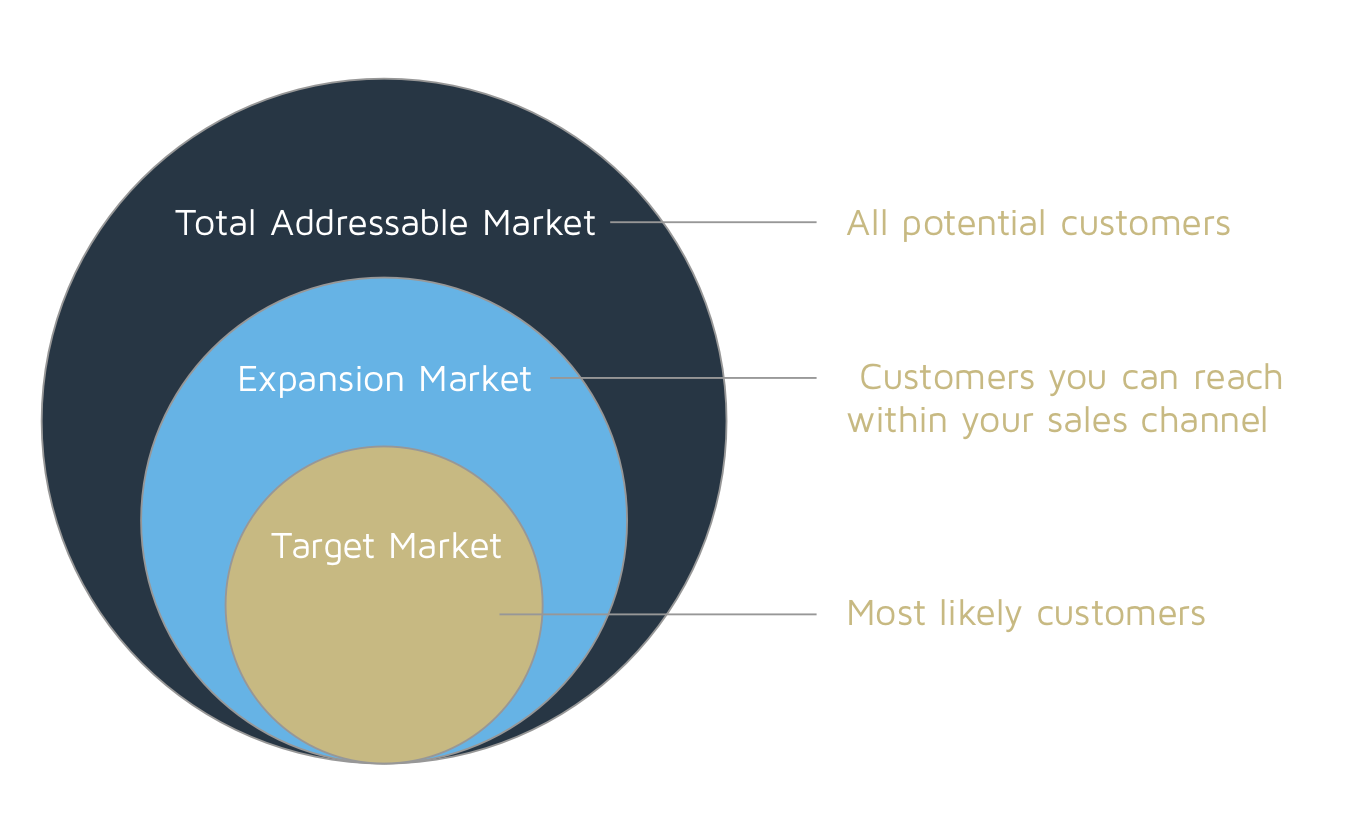

1) Market Size: Every good story starts with a hook and every good investment starts with the potential for an outsized return. One of the most commonly cited numbers in a market analysis is the Total Addressable Market, or TAM. This is typically calculated by looking at the total number of possible customers over a year, multiplied by the amount each of them would pay for your service, or Annual Contract Value.

TAM = ACV * # customers

While one of the most important figures you must address, TAM inherently uses many assumptions, and some come with potential complications. It is fair to say that all forecasts will be wrong; they are, after all, predictions of the future. Therefore, the objective in forecasting is to produce a facsimile of the future that is the least wrong and where it is wrong, for it to be so in a manner that accrues a benefit rather than a loss to the forecaster. If one is too conservative in one’s forecasts, opportunities will be missed. On the other hand, forecasts that are too aggressive will yield shortfalls in expectations and disappointment. To avoid these problems, one should use known data and similar companies and industries to draw your conclusions. Above all else, it’s important to be reasonable, and make sure the founders are too. Make sure to include some low-end, pessimistic numbers as well as some high-end, optimistic estimates in your calculations.

2) Market Dynamics: Now that you’ve set the TAM in which the company you are assessing is operating, the next step is to assess the dynamics of this market. While each market and company will come with its own unique set of characteristics, some common questions or issues will need to be addressed. For example, companies in quickly evolving markets need to be able to adapt to internal changes and growth of the company as well as to external changes outside of their control. Is the team capable of this kind of agility? (refer to the previous post about the founding team).

Also, assessing how the market is changing in tangible ways and whether the team is addressing these changes are common problems. A simple google search for industry trends and white papers can yield very insightful data and at far less cost than the thousands of dollars charged by major firms for in-depth analysis. Trade associations offer a wealth of knowledge about current trends and their publications can help you quickly get up to speed on movements in the industry.

Example of music industry trade associations

These changes can include things like:

- Technology: See our upcoming post about assessing the technological viability of a start-up. What kind of technological advantage does the start-up have? Is their technology proprietary and is it protected, or is it technology that is readily available that is being used in a new and unique way?

- Demographics: Who are the customers and how are they changing? This will affect your future market position and should be included in planning today.

- Key Opinion Leaders (KOLs): This is a complicated one, and you’ll need to get creative, but a good place to start is a publication or trade association in the field the start-up works in.

While there never is a final answer in forecasting these issues, developing a good process and systematic way of limiting forecasting error and improving outcomes when errors do occur is one of the most important first steps for entrepreneurs and investors alike. These tools should help start the process on solid footing.

This page was written by Brian Galea and Jeffrey Camp. Mr. Galea is a member of the Cane Angel Network investment team and is pursuing his MBA at UM graduating in 2021. Mr. Camp is the Managing Director of the Cane Angel Network.