On April 24th, 2020, President Trump signed into law the Paycheck Protection Program and Health Care Enhancement Act (CARES Act 3.5) to refill the depleted funds provided in the CARES Act passed on March 30th. Below, is a breakdown of the new additions and how it will affect small businesses.

And for a quick recap of the CARES Act stimulus bill and how to apply, see our previous post here.

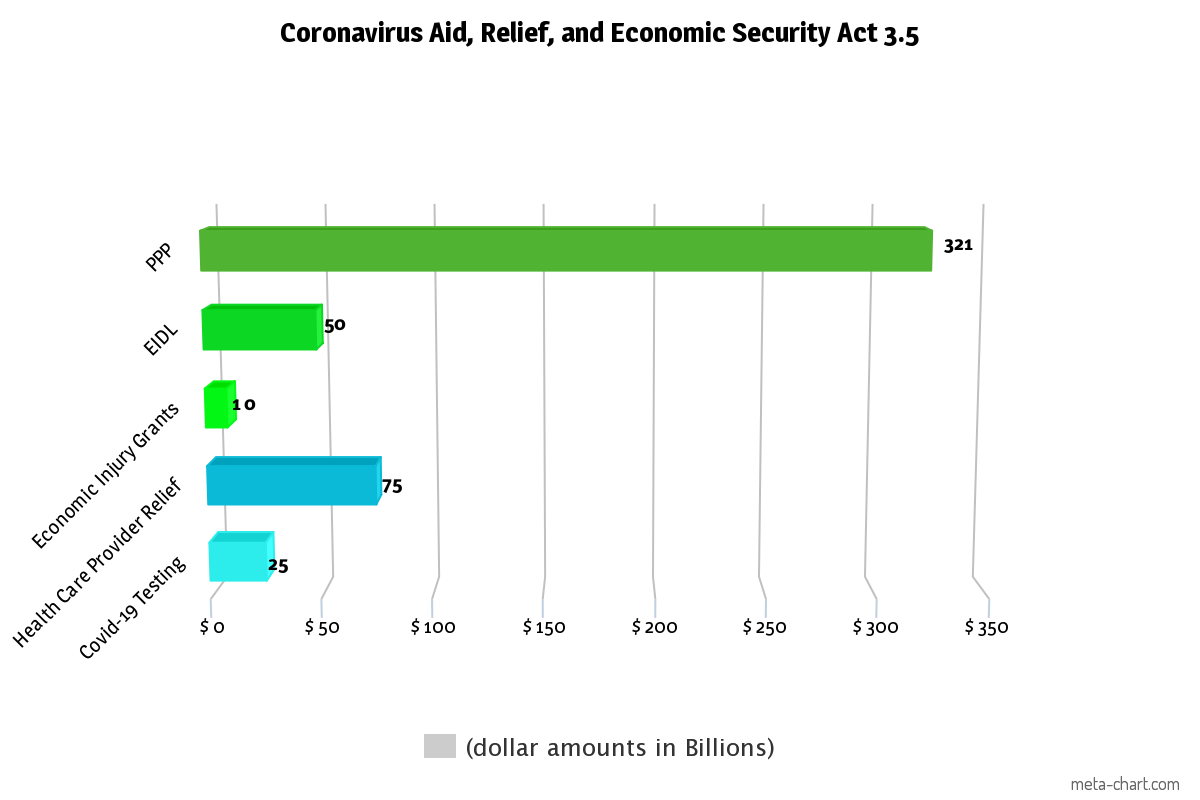

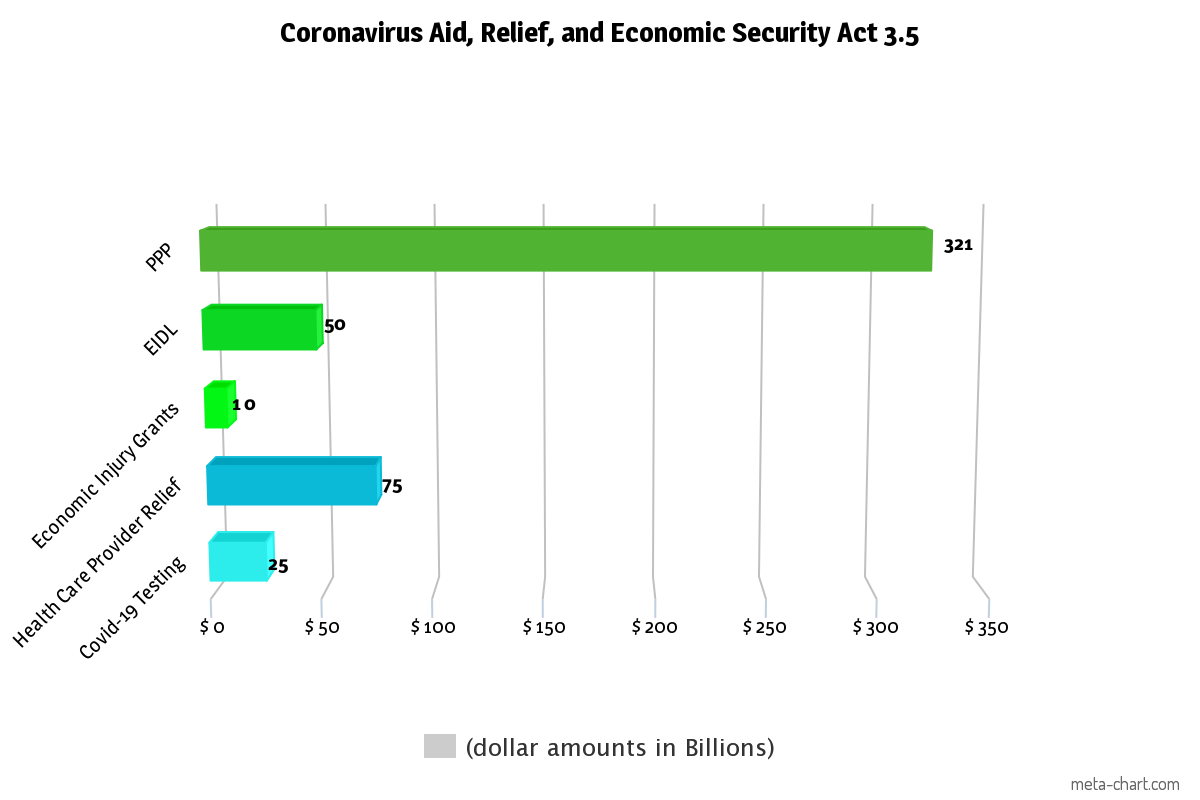

While the CARES Act 3.5 adds $75 billion to support healthcare providers and $25 billion to support COVID-19 testing efforts, the bulk of the funds are going to small business programs, specifically the Payment Protection Program (PPP) and Economic Injury and Disaster Loan (EIDL).

Specifically, the CARES Act 3.5 totals $484 billion in its expenditures to the small business programs. The funds are allocated in three parts, as follows:

-

The Paycheck Protection Program, the most popular portion of the CARES Act, was depleted within weeks of its commencement. As of April 24th, the PPP will be replenished with $321 billion in funds, as well as stricter rules for the size of companies eligible for support. In addition, it loans up to $10 million with potential for repayment forgiveness.

-

The Economic Injury and Disaster Loans (EIDL) program will be replenished with $50 billion. It loans up to $2 million with interest rates as low as 3.75% for companies or 2.75% for non-profits.

-

Lastly, the Disaster Loans Grant Program that allowed emergency disbursement of up to $10,000 with no repayment has now been replenished with $10 billion in funds.

Remember to check out our previous post on the CARES Act and government documentation.

To read more about the CARES Act 3.5:

- Congress Passes CARES Act 3.5 to Replenish Certain CARES Act Funds, Establish COVID-19 Testing Fund – Click here

- Nonprofit CARES Act 3.5 - $484 Billion Relief Package – Click here

The ‘Cane Angel Network is here to help you. Reach out to us with any questions: caneangelinfo@miami.edu

This page was written by Brian Galea, Osaro Qualis, Farah Sheikh, and Jeffrey Camp.

Brian Galea is a full-time MBA student at the Miami Herbert Business School. His background is in Biology and Anatomy and he is currently pursuing a career in venture capital. He is dedicated to the entrepreneurial spirit and sustained growth of the startup community in his hometown of Miami.

Osaro Qualis will be completing his Juris Doctorate from the University of Miami’s School of Law in early May of 2020. In addition to being a student investment team member in the ‘Cane Angel Network, Mr. Qualis is currently a Student Fellow in the Startup Practicum under Professor, Daniel Ravicher.

Ms. Farah Sheikh will be completing her Juris Doctorate from the University of Miami’s School of Law in early May of 2020. While a Student Investment Team member of the ‘Cane Angel Network, Ms. Sheikh is also a current Student Fellow in the Startup Practicum under Professor Daniel Ravicher’s instruction of intellectual property, business entity formation, and dealing with business founders. Upon Ms. Sheikh earning her Law degree, she plans to pursue a career in entrepreneurship and investing.

Mr. Camp is the Managing Director of the Cane Angel Network.