US healthcare venture capital (VC) funding set a new record in 2019 at 10.7 billion, a 10% increase from 2018. Although this may look appealing to healthcare entrepreneurs, most of this funding occurs during later-stage investments. For healthcare startups that are early on in the growth process, securing funding can be a difficult and time-consuming process. The ‘Cane Angel Network helps companies navigate the sources of capital to come to the best outcome for the start-ups we work with to raise funding. This article outlines funding pathways that healthcare startups can pursue.

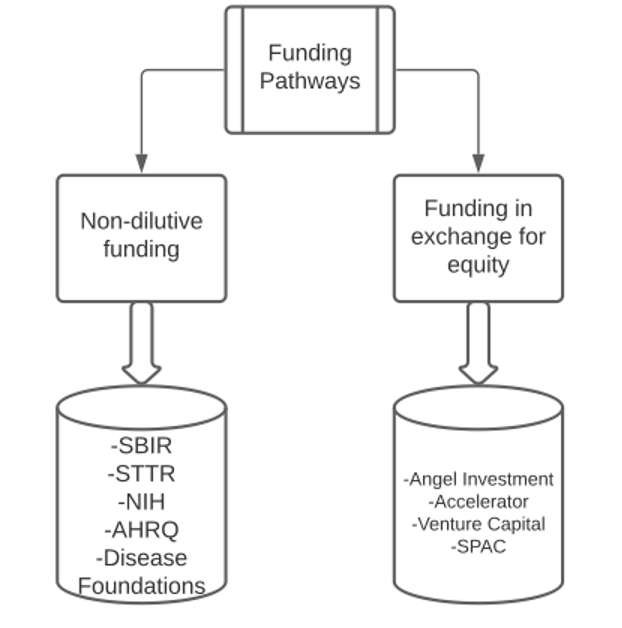

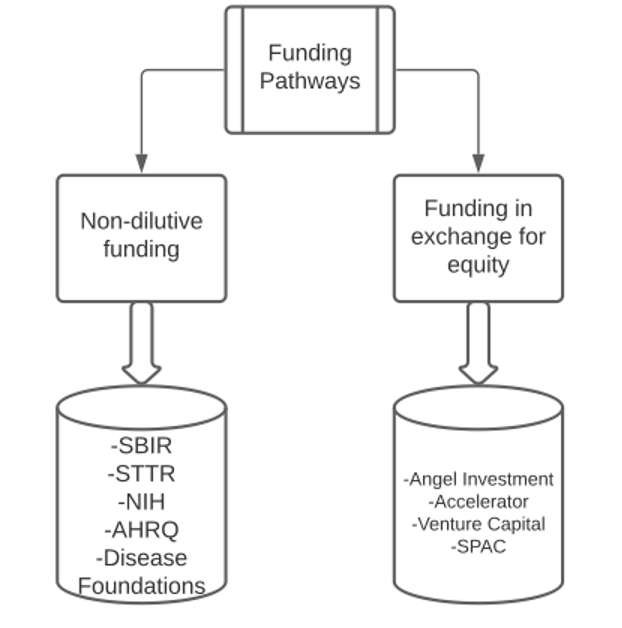

It is recommended for startups to first seek non-dilutive funding. That is funding that does not take any equity from the company and comes in the form of grants. Below are 5 different options that provide billions in non-dilutive funding to startups in the US.

Options 1 and 2:

The Small Business Innovation Research (SBIR) and Small Business Technology Transfer (STTR) are federal programs that provide over $2.5 billion in federal grants to domestic small businesses to stimulate technological innovation. To be eligible, companies must be for-profit, more than 50% owned and controlled in the US, and have no more than 500 employees. These programs are structured in three phases.

- Phase 1: Awards between $50,000 to $250,000 for 6 months in SBIR or 1 year in STTR. The objective is to determine technological merit to the research and development and the commercial potential of the product.

- Phase 2: Awards are generally 750k for 2 years. Funding is based on the results from phase 1 and typically a phase 2 award is only granted for those who received a phase 1 award.

- Phase 3: There is no SBIR/STTR funding for phase 3. However, there may be follow-on non-SBIR/STTR government funding for products or services intended for use by the government.

Agrology.ag, a start-up that worked with the ‘Cane Angel Network to raise funds, provides a good example of how this process might work in practice. Agrology, a promising start-up in the Agtech market, had secured $250,000 in SBIR Phase 1 funding, which is used to develop its initial prototype and test in the market. This gave the company valuable market feedback on its devices and software, as well as real results that investors could rely on as a proof of concept. Agrology then successfully applied for the Phase 2 SBIR funding, securing $1M in non-dilutive capital. While these funds can only be used for tech R&D, investors know that money is fungible and the SBIR funding will alleviate a funding burden that the company would otherwise need to address. In addition, the SBIR will match $1 per $2 raised in private capital up to $500,000. The SBIR funds significantly de-risked the investment in Agrology by providing the early capital needed to develop their product and prove it in the market, and then provided follow-on funds to continue their tech R&D. This was a win-win for all parties.

More information on the SBIR and STTR application process can be found here:

Option 3:

The NIH is made up of 27 institutes and centers (IC) each of which has a distinct mission that focuses on a disease area, organ system, or stage of life. IC’s award more than 80% of the NIH’s annual budget to support investigators in these areas while only about 10% of the NIH budget supports NIH laboratories. The ‘Cane Angel Network works with many NIH funded start-ups since the University of Miami’s Miller School of Medicine is the #1 NIH funded school in Florida and its Dept. of Human Genetics is #2 in the nation. The grant process overview and funding applications can be found here: https://grants.nih.gov/funding/searchguide/index.html#/

Option 4:

Disease Foundations: The practice of “venture philanthropy” that is a non-profit entity providing funding for a for-profit company has been increasingly common. This funding enables healthcare startups to de-risk and accelerates the development of new therapeutics. Funding from disease foundations can also facilitate follow-on funding from governmental agencies and incentivize larger companies to partner sooner. A few examples of disease foundations that provide grants are the Cystic Fibrosis Foundation, the Juvenile Diabetes Research Foundation, and the Michael J. Fox Foundation for Parkinson’s Research.

Option 5:

The Agency for Healthcare Research and Quality is a federal agency with a mission for improving the safety and quality of America’s healthcare system. AHRQ has an annual budget of $436 million and awards grants for research to improve the quality, effectiveness, accessibility, and cost-effectiveness of health care. More information on funding announcements and applications can be found here:

As an alternative to receiving money from grants, companies can seek to secure an investment. Angel investors, accelerators, and/or venture capitalists provide money in exchange for equity in a company. These investments are often secured by a startup after receiving grants and are an option to obtain a significantly larger amount of capital. The following options are described below.

Angel investors:

Angel investors can be individuals or groups, such as the ‘Cane Angel Network. Investments often are made during a priced round. This is when the value of a company is determined and an investment is made in exchange for equity in a company. The first round of funding is called a “seed” or “angel” round. Angel round deals typically range from $150K to $1.5M, and some angel groups may provide management expertise to start-ups not yet ready for funding. Oftentimes angel investment groups will invest in a pooled fashion to de-risk their investment and will bring in large partners to assist in diligence.

Accelerators:

Accelerators work with startups to provide mentorship, networks, coaching, and funding to help startups achieve growth and success. Accelerators can provide great value to fledgling companies and often provide the strategic partnership entrepreneurs need to help get them off the ground. Prominent healthcare accelerators include Roch Health, Healthbox, and Blueprint Health. They typically offer a 3 to 6-month support program and seed funding from $50K to $1M. At the series A level and beyond, funding has also grown significantly for healthcare software startups.

Venture Capital (VC):

After angel funding, venture funding is typically available for companies in a later phase of growth which are 2-3 years away from an IPO or sale. These next funding rounds are called Series A, B, and C. Typical VC investment in Series A is between $2M to $15M, for Series B investment is typically between $15M to $50M, and for Series C investment is typically between $50M to $100M. Most of VC funding in early rounds in 2020 went to telemedicine, mHealth apps, data analytics, and clinical decision support companies. The industry-leading VC firms include Kleiner Perkins, Lux Capital, CRV, and RRE Ventures.

Special Purpose Acquisition Company (SPAC):

A recent trend has been the increased use of SPAC’s to acquire large healthcare startups. A SPAC is a company that is formed for the sole purpose of raising capital to acquire another company. SPAC’s do not have any products, services, or commercial operations. SPAC’s are formed by investors with expertise in a particular industry, which then raises money in an IPO. The funds raised must be used to complete an acquisition within a specified time or else the money is returned to the investors. In 2020, 50 SPAC’s have been formed which have raised over $20 billion. Two recent healthcare deals include VG Acquisition Corp acquiring DNA analytics company 23andMe for $509 million in cash and $250 million in private equity. Also, GigCapital will merge with two telemedicine firms, UpHealth and Cloudbreak.

To summarize, there are numerous funding pathways a healthcare startup can pursue. It is important for entrepreneurs to learn about each pathway and determine which one best aligns with their goals. Best of luck!

This page was written by Dylan Luxenburg and Jeffrey Camp with contribution from Navin Balaji. Mr. Dylan Luxenburg is a member of the Cane Angel Network investment team and is pursuing his MD at UM graduating in 2024. Mr. Camp is the Managing Director of the Cane Angel Network.